- Analytics

- Market Overview

US dollar index hit a multi-year high - 15.11.2016

Growth of stock indices stalled

US currency continued strengthening on Monday while stock indices fell. The economic policy of new US President which implies industrial stimulus may lead to higher inflation.

Markets believe Fed is to hike interest rate on December 14, 2016. Chances for the rate hike now exceed 90%, according to FedWatch. Amid this, US dollar index again approached its high since 2003. Yields of 10-year treasuries reached their 10-month high. Yuan fell to its 8-year low which also made US dollar stronger. Investors worry the policy of Trump may reduce the volume of orders from US companies in China. No significant economic news came out in US yesterday. US stocks edged lower as Fed rate hike may raise credit burden on US companies. IT stocks were the bottom performers: Apple, Amazon, Microsoft and Facebook. Investors transfer their funds from them to real sector and bank stocks which may advance on Trump’s policy. Today at 14-30 СЕТ October retail sales and at 16-00 СЕТ Business inventories for September will come out in US. Tentative outlook is modestly negative.

Banking and mining stocks advanced

European stock indices edged higher on Monday while euro continued falling. STOXX Europe Mining index rose 2.2% as metal prices rise on expectation of new stimulus measures for US industry from Trump.

European stocks advanced on negotiations of UniCredit (+3%) and Societe Generale. Stocks of German Commerzbank soared 6% on the news it may acquire Oldenburgische Landesbank. Higher than expected manufacturing production in September in Eurozone was additional positive. Today the weak German GDP data for Q3 2016 came out, they fell short of expectations. At 11-00 СЕТ the neutral Q3 GDP in Eurozone and positive September trade balance came out in Europe as well as negative German ZEW economic activity index for November.

Nikkei continues advancing

Nikkei went on rising on Monday as yen fell lower and on positive GDP and industrial production data. It edged lower on Monday due to profit taking. Since the US presidential elections, Nikkei has advanced almost 9%. Markets believe weaken yen will improve financial statement of Japanese exporters. Housing loans data for Q3 will come out in Japan on Wednesday morning.

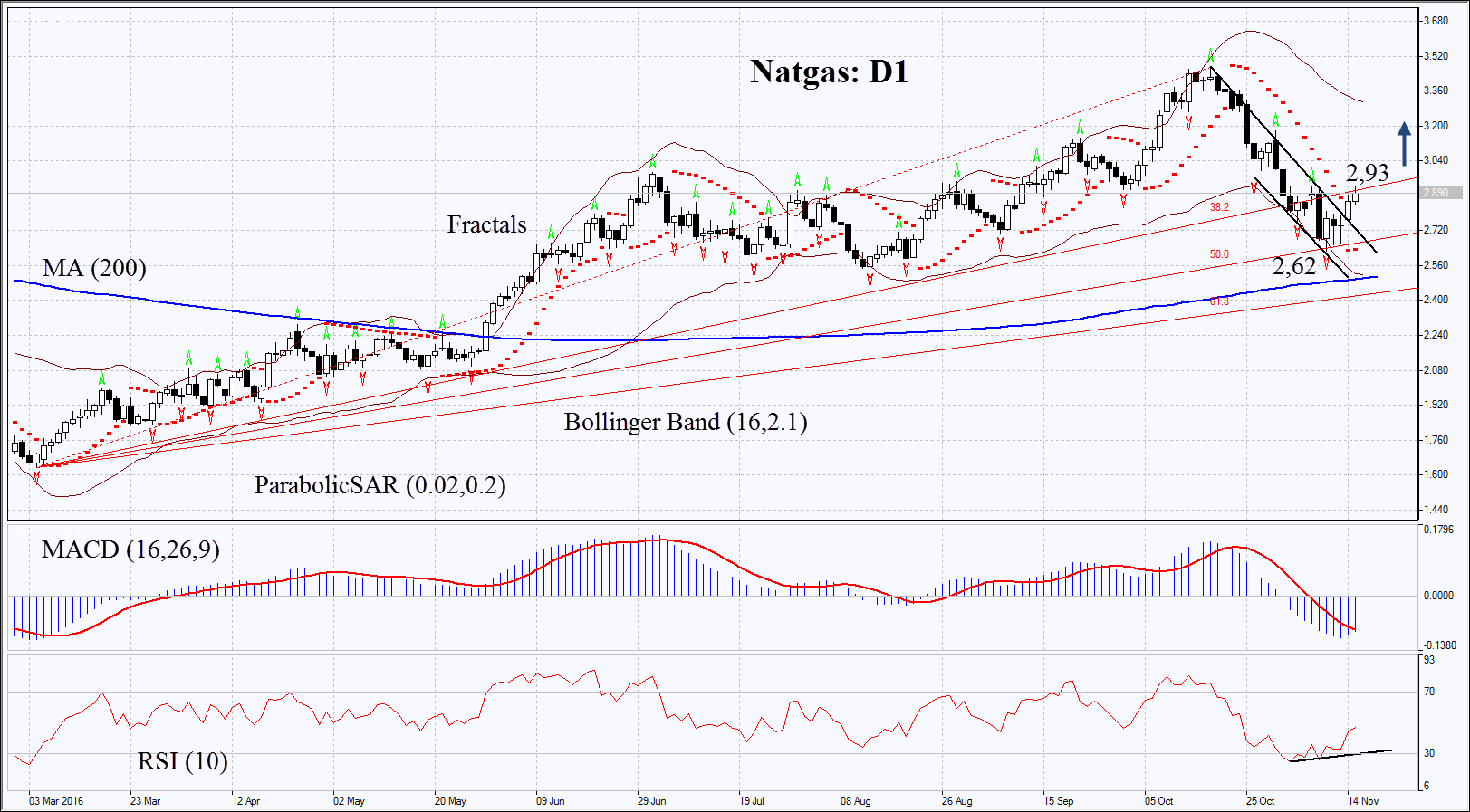

Natural gas prices rose on cold weather in US

Natural gas prices advanced 5% in US on forecasts of cold weather. This week gas consumption is expected to rise to 76.8bn cubic feet this week from 73bn a week earlier. Next week the consumption is to reach 85.3bn cubic feet a day. Average US production for recent 30 days was just 70.2bn cubic feet a day. Active gas rigs count fell in US by 2 units last week to 115 units, according to Baker Hughes. Number of shale rigs fell by 2 to 457 units.

Oil prices unexpectedly rose after Energy Minister of Saudi Arabia said OPEC members almost reached a deal on oil production freeze for November 30, 2016. Qatar, Algeria and Venezuela are the most strong advocates for that. Moreover, U.S. Energy Information Administration's (EIA) expects the US shale oil production to contract in December by 20 thousand barrels a day to 4.5mln barrels a day. This is the lowest volume since April 2014 when Brent price was around $106 per barrel.

News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also