- Analytics

- Market Overview

Global equities track US market retreat - 6.9.2018

Dollar slips on trade deficit jump

US stock market extended losses on Wednesday led by technology shares. The S&P 500 lost 0.3% to 2888.60. The Dow Jones industrial average however rose 0.1% to 25974.99. Nasdaq composite index dropped 1.2% to 7995.17. The dollar weakened as US trade deficit for July jumped almost 10%: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.3% to 95.073 but is rising currently. Futures on three main US stock indices point to lower openings today.

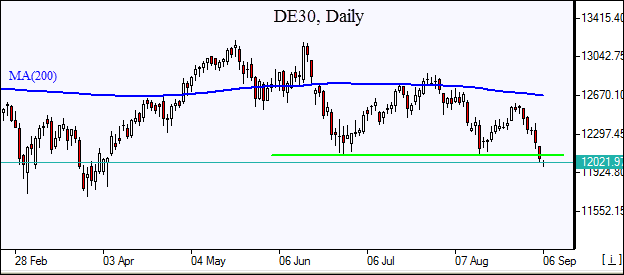

DAX 30 opens lower than other European indices

European stocks continued the pullback on Wednesday. Both the GBP/USD and EUR/USD turned higher and are rising currently. The Stoxx Europe 600 lost 0.3%. Germany’s DAX 30 ended 0.7% lower at 12131.62. France’s CAC 40 fell 0.7% and UK’s FTSE 100 slid 0.4% to 7428.89. Italian bank shares however were lifted by deputy Prime Minister Matteo Salvini comment Rome would “try to be good” with respect to European Union budget rules. Indices opened 0.1% - 0.4% lower today

Asian indices fall ahead of US tariffs measure

Asian stock indices are mostly in negative territory with traders awaiting the US imposition of tariffs on $200 billion worth of imports from China. Nikkei ended 0.4% lower at 22487.94 as yen turned higher against the dollar while as 6.7 magnitude earthquake hit Hokkaido. China’s stocks are lower as China’s commerce ministry stated that China will be forced to retaliate if the United States implements new tariffs: the Shanghai Composite Index is down 0.5% and Hong Kong’s Hang Seng Index is 1.3% lower. Australia’s All Ordinaries Index fell 1.1% despite Australian dollar’s turn lower against the greenback.

Brent gains on US stocks drop forecast

Brent futures prices are edging higher today. Prices fell yesterday after a major storm missed the bulk of the Gulf of Mexico oil and natural-gas operations platforms. The American Petroleum Institute reported late Tuesday that US crude inventories fell by 1.17 million barrels to 404.5 million last week. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories. Prices ended lower yesterday: November Brent crude lost 1.2% to $77.27 a barrel on Wednesday.

News

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also