- Analytics

- Market Overview

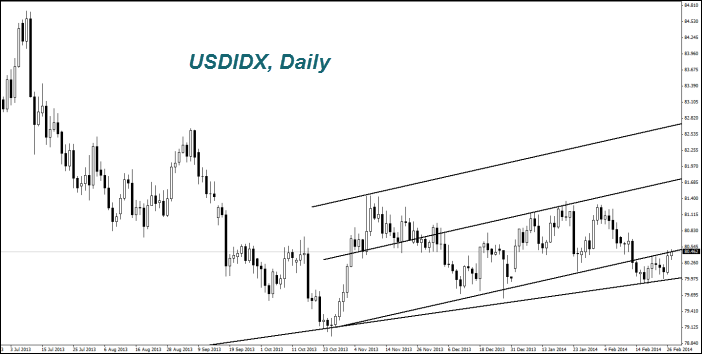

The U.S. Dollar Index rose to a 2-week high - 27.2.2014

Today, there are a lot of important macroeconomic indicators in the Eurozone to be released. At 8-55 GMT (0), we expect the unemployment data in Germany to be announced. At 10-00 GMT (0), we expect the EZ consumer confidence and Inflation in Germany at 13-00 GMT (0). In our opinion, the forecasts are negative because they increase the possibility of reducing the interest rates by the ECB. The Euro (EURUSD) may fall on the chart. At 23-30 GMT (0), there will be a lot of economic data from Japan released. We believe that the most important data is the inflation for January. Its reduction is expected. Theoretically, this can be a factor increasing the monetary issue by the Bank of Japan and also can weaken the Yen (USDJPY).

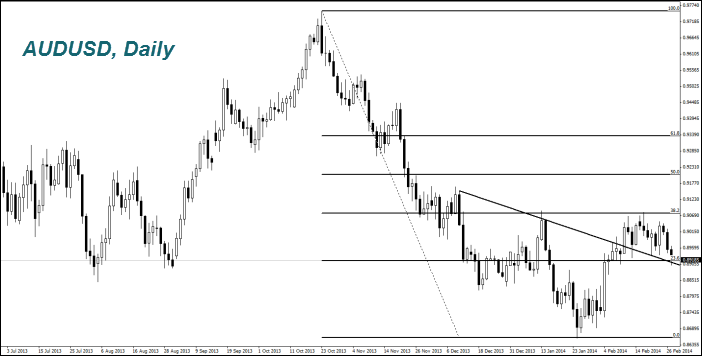

Signs of slowing down in Chinese economy and the Yuan weakening had a negative impact on the Australian Dollar (AUDUSD). An additional factor was the weak economic data that came out last night in Australia. Private investment in the fourth quarter decreased by 5.2 %. This is not the most important indicator, but now it has worked out since the fall was the highest in the last four years. Because of this, the likelihood of rate cuts in Australia is increased. Recall that the following important economic indicators will be released in the period from March 3 through March 6.

The Wheat prices are corrected downward and they fell on Wednesday by 2.5%. This is the biggest fall within the month. Investors believe that after the recent rise in Wheat prices, grain from the United States may become less competitive. This week Egypt refused to buy 110 tons of the U.S. Wheat. An additional negative factor was the decision to increase exports to Argentina by 500 tons. Most likely, this volume will be bought by Brazil, which usually imports Wheat from North America. Today at 13-30 GMT (0), the U.S. Department of Agriculture will publish the weekly data on grain and soybeans export. They can affect futures prices. In our opinion, the preliminary forecast of soybean exports is positive, and neutral for grain crops. Natural gas (Natgas) continued to fall in price. We do not exclude that this was due to yesterday repayment of another futures contract in the New York Stock Exchange (NYMEX). Today investors will be focused on the gas reserve data in the United States for this week. They come out at 15-30 GMT (0) and may be decreased according to preliminary estimates. It can support the quotations. Copper (Copper) fell because investors fear slowing down in Chinese economy. Its reserve on the Shanghai Futures Exchange rose to its peak during last nine months. The Chinese PMI is expected to come out on March 1st and it may have a significant impact on the Copper reserve.

News

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also