- Analytics

- Market Overview

On Wednesday the U.S. Dollar Index rose on the economic data - 27.3.2014

The Japanese Yen strengthened ( it looks like decrease in the USDJPY chart) through the actions of several Japanese public pension funds in the stock market. As it was known yesterday they reinvested dividend income on the stock market. The Nikkei index was closed at 2-week high. According to the Japanese Ministry of Finance weekly data, foreigners purchased more Japanese securities than Japanese traders bought foreign securities. This is better than expected, which also helped the strengthening of the Yen yesterday. In our opinion, it may be temporary, as Japanese government is going to continue its QE policy by printing money. Note, that the growth in its volume can be made no earlier than June when it will be possible to evaluate the effect of increasing the sales tax . Tomorrow night at 00-30 CET in Japan will be released very important inflation macroeconomic data, unemployment and retail sales for February. Preliminary forecasts are neutral. Therefore, the data may affect the Yen, if they differ significantly from the predicted values. Note that inflation in Japan is measured by the National Consumer Price Index Ex-Fresh Food. The Bank of Japan is going to start the emission as soon as the index reaches 2%.

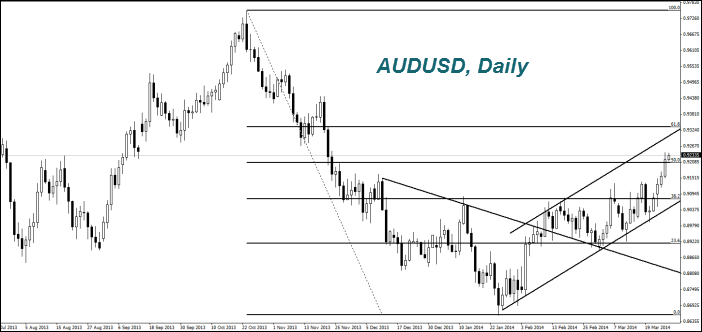

The Australian Dollar ((AUDUSD) continued its growth. In our opinion, yesterday there were no special reasons for it . It moved along with the New Zealand Dollar (NZDUSD), which updated its 11-months maximum. This is due to the NZ trade surplus growth in February to NZ $818 million, which was its highest since April 2011. Moreover, market participants continue to react to the increase in the interest rates of New Zealand, which occurred on March 13th. We do not exclude a downward correction on the AUD chart before the significant economic data in Australia next week.

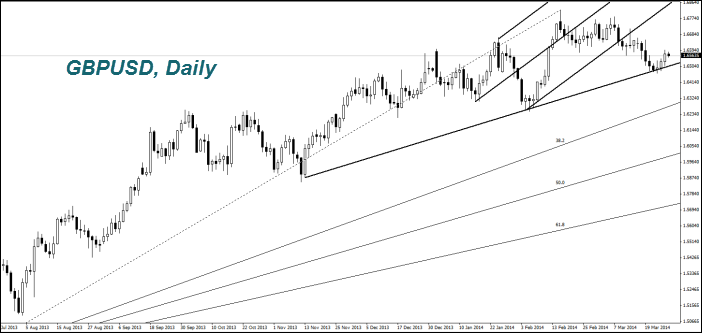

As we predicted in previous overviews, the GBPUSD got stronger after Tuesday inflation data. Yesterday the trend has continued due to the BOE representative, Martin Weale, who said he should raise interest rates along with British economy recovery. Recall that the rate has been 0.5% since March 2009. The next BOE meeting over its changes will be held on April 10th. The XAUUSD continued to decline. Meanwhile, India — its second consumer in the world after China, plans to reduce import fees on the Gold in the second half of this year. The Gold import to India declined by 57% to 205 tons in the second half of last year due to customs restrictions. The decline was 4% to 825 tons for the whole year. China acquired 1065.8 tons of the Gold in 2013. According to some estimates, the demand in India may exceed the Chinese one by 40-50% in case of fee cancellation. This could have a positive impact on the prices. The Soyb prices may increase in case of a possible reduction of its stocks in the United States. According to the forecasts, they will make 987 million bushels (26.9 million tons). This is the lowest level since 1965 and only 30% of the estimated domestic consumption and exports, which increases the importance of the new crop. The data on stocks and production forecast for this season will be published by the Ministry of Agriculture on March 31th. The Soybean exports increased by 22% and reached 39.7 million tons since September 1st of the last year. While in the previous forecasts, it was 41.6 million tonnes in 2013/14 (until August 31, 2014 ). Demand for the soybeans in China has grown considerably since it has actively used as pig food.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also