- Analytics

- Market Overview

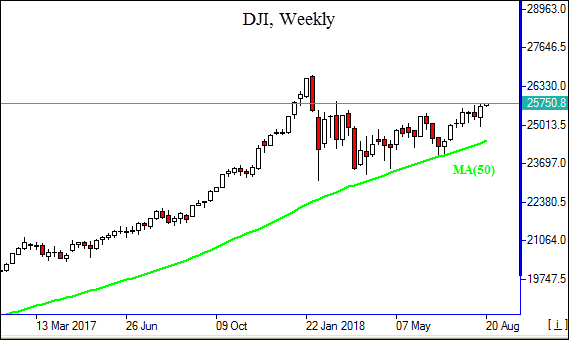

Three main US indices extend gains - 20.8.2018

SP500 turns higher for the week

US stock market extended gains on Friday on US-China trade talk resumption optimism. S&P 500 gained 0.3% to 2850.13, ending 0.6% higher for the week. Dow Jones industrial average rose 0.4% to 25669.32. The Nasdaq added 0.1% to 7816.33. The dollar weakening accelerated as the University of Michigan consumer-sentiment index in August fell from 97.9 in July to 95.3, the lowest level in 11 months: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.2% to 96.09 but is higher currently. Stock index futures indicate higher openings today.

DAX 30 opens higher than main European indices

European stocks pulled back on Friday led by Italian bank shares. Both the EUR/USD and GBP/USD accelerated their climb but both pairs are lower currently. The Stoxx Europe 600 Index slipped 0.1%, ending 1.2% lower for the week. The DAX 30 slid 0.2% to 12210.55. France’s CAC 40 lost less than 0.1% while UK’s FTSE 100 added less than 0.1% to 7558.59. Markets opened 0.2% - 0.4% higer today.

Chinese shares lead Asian indices gains

Asian stock indices are mostly rising today as investors await the US-China talks in Washington on August 21 and 22, just before US tariffs on $16 billion of Chinese goods take effect. Nikkei lost 0.3% to 22199 despite a yen turn lower against the dollar. Chinese stocks are gaining as yuan rose against the dollar retreating from a psychologically important 7.0000 level: the Shanghai Composite Index is up 1.1% and Hong Kong’s Hang Seng Index is 1.3% higher. Australia’s All Ordinaries Index is up 0.1% as the Australian dollar turned lower against the greenback.

Brent extends gains

Brent futures prices are inching higher ahead of Iran sanctions. Prices rose Friday as the US and China prepared to resume trade talks next week: Brent for October settlement rose 0.6% to close at $71.83 a barrel Friday, ending 1.3% lower for the week.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also