- Analytics

- Market Overview

US stocks pull back - 29.12.2016

Dow ends further away from 20000 level

US stocks ended lower on Wednesday led by technology stocks. The dollar continued the uptrend. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.2% higher at 103.223. The S&P 500 closed 0.8% lower at 2249.92, led by losses in financial and materials stocks with all eleven main sectors finishing lower. The Dow Jones industrial average ended 0.6% lower at 19833.68, trading within 20 points of the psychologically important 20000 milestone but still failing to break above. Losses in biotechnology shares pulled down the high tech index Nasdaq 0.9% to 5438.56.

The recent stock rally started in early November with president-elect Trump’s proclaimed support for tax cuts and fiscal stimulus programs raising expectations of accelerated economic growth. However many analysts are pointing to high stock valuations which may justify taking profits and locking in the year’s gains. In economic news, pending home sales in the US fell 2.5% in November, dropping to their lowest level in nearly a year. Today at 14:30 CET November advance Goods Trade Balance, Wholesale Inventories will be published in US. At the same time Initial Jobless Claims and Continuing Claims will be released , the outlook is positive for dollar.

Mining stocks lead European markets higher

European stocks advanced on Wednesday led by mining stocks. Both the euro and the British Pound weakened against the dollar. The Stoxx Europe 600 extended gains rising 0.3%. Germany’s DAX 30 edged up 2.75 points to 11474.99. France’s CAC 40 slipped 0.01% and UK’s FTSE 100 index outperformed gaining 0.5% to 7106.08.

Shares of miners Fresnillo and BHP Billiton jumped 5.2% and 4.3% respectively, helping lift the commodity-heavy FTSE 100 index. Losses in Italian banks limited gains in the pan-European index as investors focused on developments around the troubled Banca Monte dei Paschi di Siena after the European Central Bank found the bank needs to boost its capital €8.8 billion instead of the €5 billion expected when the government last week organized a rescue for the lender. Shares of Banca Monte dei Paschi di Siena were still halted for trade. No important economic data are expected today in euro-zone.

Drop in Toshiba shares pulls Nikkei down

Asian stocks are mixed today as the decline on Wall Street weighed on market sentiment. Nikkei fell 1.3% to 19145.14 to three-week low with yen growing stronger against the dollar. Shares of Toshiba fell 17%, on uncertainty how much loss Toshiba would have to record and how much it would need to raise to restore its capital base. The Hong Kong’s Hang Seng index is up 0.1% while the Shanghai Composite Index is down 0.2% weighed by declines in financial stocks. Australia’s All Ordinaries Index gained 0.3% while the Australian dollar edged higher against the dollar.

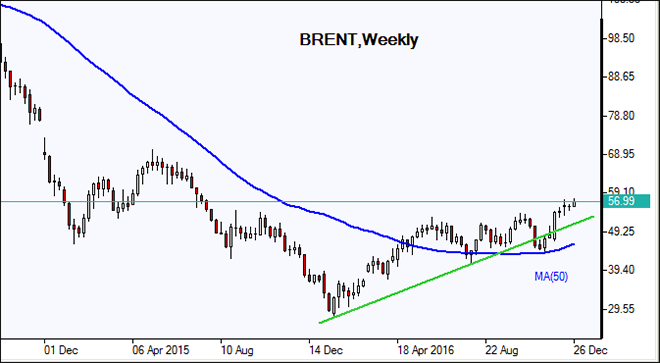

Oil prices rise despite surprise US inventory build

Oil futures prices are rising today despite a surprise build in US crude inventories. The American Petroleum Institute private industry group reported on Wednesday that US crude oil inventories rose 4.2 million barrels in the latest week. Official inventory data from the Energy Information Administration will be released today at 16:30 CET. Analysts surveyed by The Wall Street Journal expect a 1.4 million barrel decline in crude supplies. February Brent crude closed 0.2% higher at $56.22 a barrel on Wednesday on London’s ICE Futures exchange.

News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also