- Analytics

- Market Overview

The Federal Reserve will not rush to raise the rate, but it still can be done by the end of the year. - 21.2.2019

There was nothing certain in the materials of the January Fed meeting

The American regulator will not be in a rush to raise rates. This message pleased the stock market participants and contributed to the growth of quotations. Now the S&P500 is 18% above its December minimum and 5% lower than the historical maximum reached in September last year. The world prices rose for oil and metals contributed to an increase in the industry S&P materials index by 1.7%. An additional positive impact on the market was the announcement by US President Donald Trump that he would impose duties on European cars if he could not negotiate with the European Union on reducing the deficit in mutual trade. The ICE US Dollar Index has gained since the Fed reserve has highlighted the stability of the American labor market and the economy as a whole in its January materials. Today at 14:30 CET the data on orders for durable goods, weekly unemployment, three Markit indexes and data on sales of secondary real estate will be published in the United States.

The European stock indices gained

Eurozone's preliminary consumer confidence index for February was positive, which contributed to the growth of stocks and the euro. EURUSD again entrenched above the psychological level of 1.13. For the stock market the positive empact was done by good quarterly reporting of Irish food producer Glanbia (+ 12.9%), Danish IT company Simcorp (+ 7%), as well as good forecasts by the German manufacturer of medical equipment for kidney treatment Fresenius (+ 5%). Air France-KLM reported an increase in efficiency, which will compensate for the rise in price of fuel and its quotes increased by 6%. Today will be released inflation and business activity indexes in Germany by Markit /BME in the EU, as well as business activity indices for the entire Eurozone.

Japanese Nikkei continued its growth for the 4th day in a row

Investors expect the successful completion of the current phase of the US-China trade negotiations. Shares of Japanese companies supplying their products to China were in good demand: Yaskawa Electric and Fanuc. The Santen Pharmaceutical company announced the purchase of its own shares and they have risen by 5%. AnGes biopharmaceutical quotations rose by 16% due to the approval of its new medicine by the Ministry of Health of Japan. Australian and New Zealand dollar showed a noticeable weakening after the Chinese port of Dalian stopped accepting coal from Australia in connection with the filling of previously approved quotas. An additional negative was the announcement by the Reserve Bank of Australia about a possible rate cut.

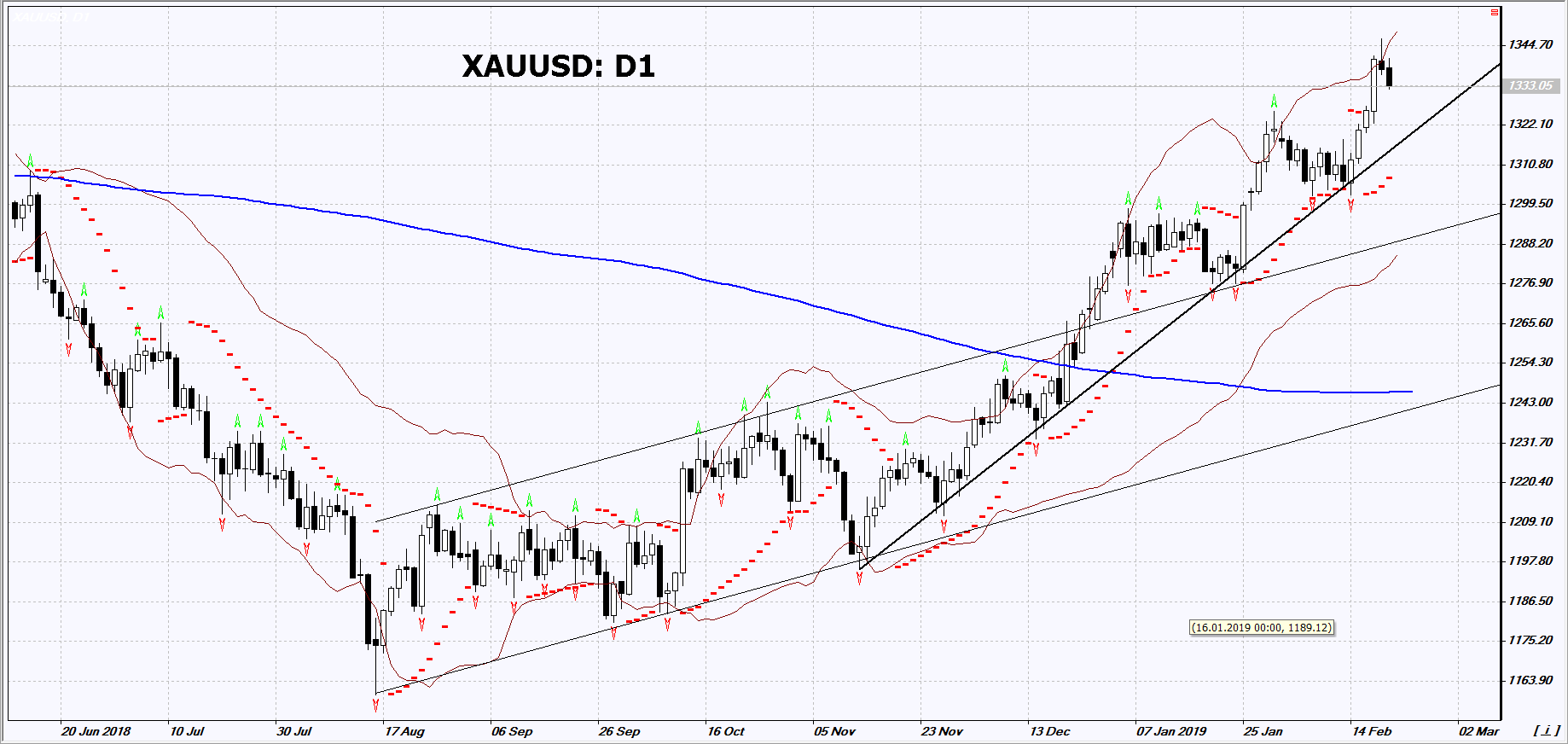

Quotations for gold adjusted down from a 10-month maximum

Based on the published materials of the January Fed meeting, investors decided that the US regulator may raise the rate at least once this year. This slightly strengthened the US dollar and weakened gold. Generally these assets are an alternative to each other and their quotations move out of phase. An additional negative for precious metals may be the success of the US-China trade negotiations which reduce global risks.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also