- Analytics

- Technical Analysis

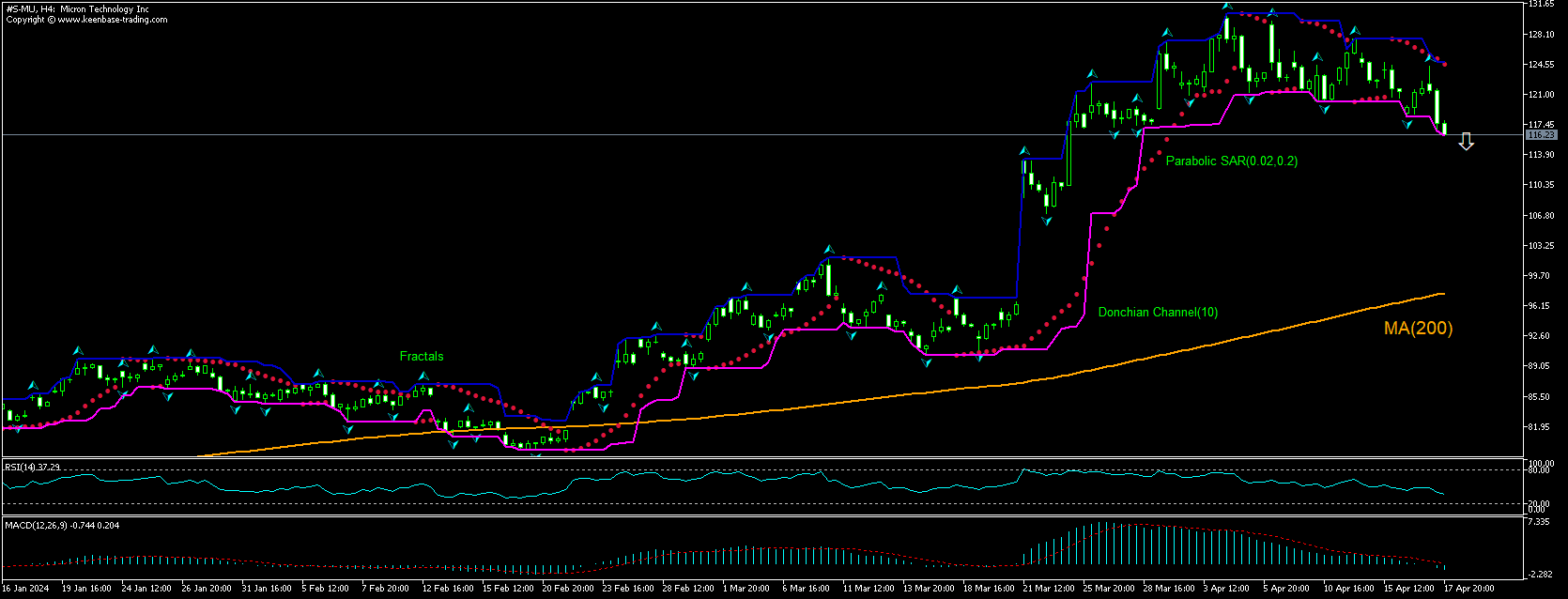

Micron Technology Technical Analysis - Micron Technology Trading: 2024-04-18

MU Technical Analysis Summary

Below 116.15

Sell Stop

Above 124.48

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Sell |

| Parabolic SAR | Sell |

MU Chart Analysis

MU Technical Analysis

The technical analysis of the Micron stock price chart on 4-hour timeframe shows #S-MU,H4 is retreating toward the 200-period moving average MA(200) which is rising still. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 116.15. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 124.48. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (124.48) without reaching the order (116.15), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - MU

Micron stock edged up after news US government will provide over $6 billion support to Micron for chip production in US. Will the Micron stock price reverse retreating?

The Biden administration has reached an agreement to provide $6.1 billion for Micron Technology to produce advanced memory computer chips in New York and Idaho. The funding comes from the 2022 CHIPS and Science Act, which is set to provide government support for chip manufacturers to produce chips in US. Micron plans to invest $100 billion in upstate New York over the next two decades. Micron stock edged up 1.82% in after-hours trade following the announcement. Government aid for expanding production is bullish for a company stock. Micron stock peaked two weeks ago after the earthquake in Taiwan. Micron Technology announced last week the April 3 earthquake in Taiwan would hurt a calendar quarter of its dynamic random access memory - DRAM supply by up to a mid-single digit percentage. Chip supply shortage is bearish for Micron stock price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.