- Analiz

- Teknik analiz

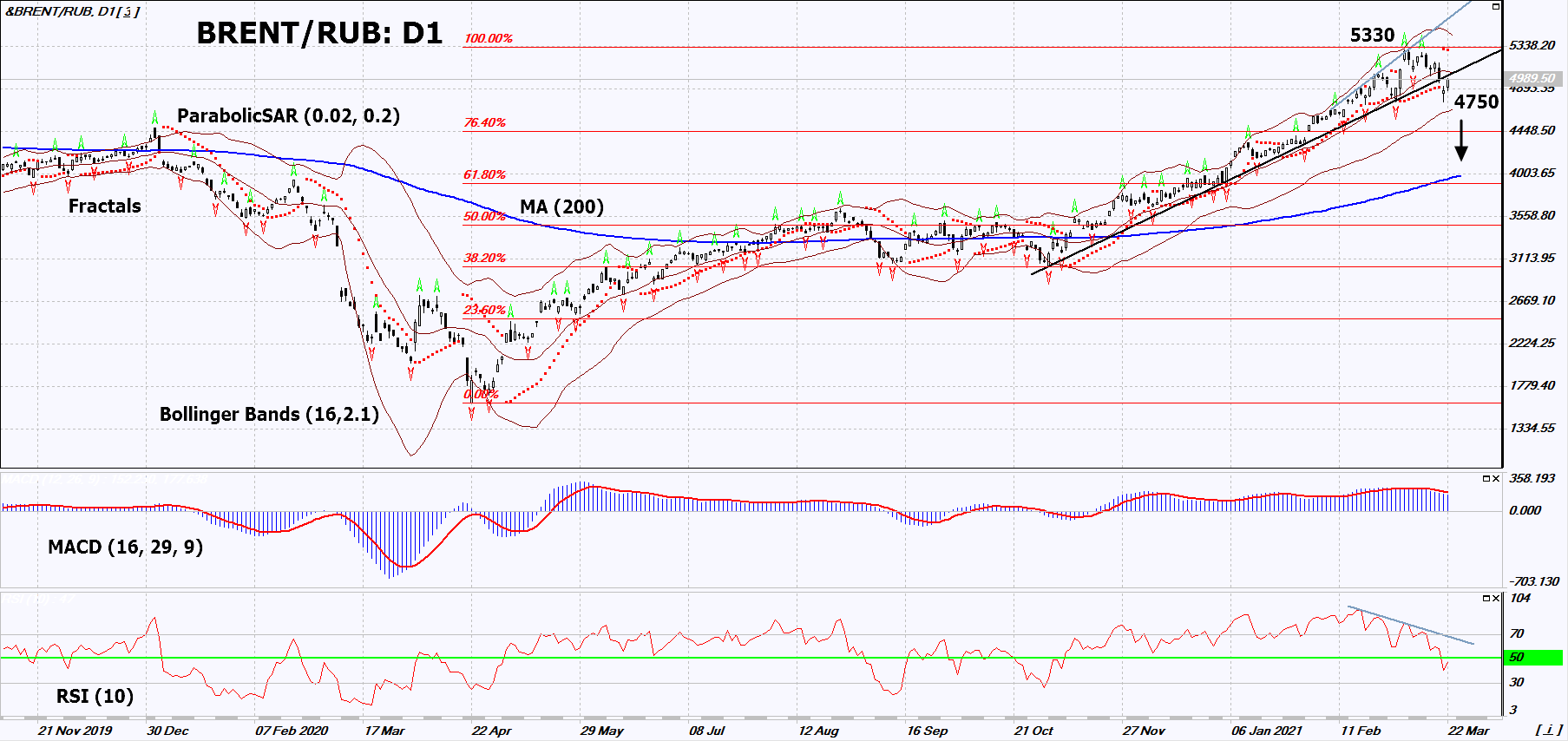

BRENT petrol / Ruble Teknik Analiz - BRENT petrol / Ruble Ticaret: 2021-03-23

Ruble'ye karşı BRENT petrol Teknik Analiz Özeti

Below 5330

Sell Stop

Above 4750

Stop Loss

| Gösterge | Sinyal |

| RSI | Sat |

| MACD | Sat |

| MA(200) | Nötr |

| Fractals | Nötr |

| Parabolic SAR | Sat |

| Bollinger Bands | Nötr |

Ruble'ye karşı BRENT petrol Grafik analizi

Ruble'ye karşı BRENT petrol Teknik analiz

On the daily timeframe, BRENT/RUB: D1 breached down the uptrend support line. A number of technical analysis indicators formed signals for a further drop. We do not exclude a bearish move if BRENT/RUB falls below the last low: 4750. This level can be used as an entry point. We can place a stop loss above the high since October 2018 and the Parabolic signal: 5330. After opening the pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal maximum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (5330) without activating the order (4750), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Temel analiz PCI - Ruble'ye karşı BRENT petrol

In this review, we suggest considering the "BRENT vs the Ruble" personal composite instrument (PCI). It reflects the dynamics of changes in the cost of a Brent barrel against the Russian currency. Will the BRENT/RUB quotes go down?

PCI declines when oil gets cheaper and the ruble strengthens against the US dollar and, on the contrary, it grows when oil prices rise while the ruble weakens. By contrast, the Russian currency tends to strengthen at high oil prices and weaken at low oil prices. Because of this, BRENT/RUB quotes usually fluctuate around their long-term, 200-day moving average. Now they have deviated noticeably from it. In other words, the ruble remains weak against the US dollar despite strong growth in world oil prices. Recall that the all-time high of this PCI was at 5909 in October 2018. Now it is below this level, but at the same time, it breached down the upward trend line. PCI fluctuations around the moving average are due to the Russian export structure. According to Russian Customs statistics, the share of fuel and energy products exported from Russia to non-CIS countries in 2020 amounted to 53.8% (66.9% in January-December 2019). The slight decrease is due to the drop in world oil prices because of the coronavirus pandemic.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop out seviyesi %10

Ready to Trade?

Open Account Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.