- Analiz

- Teknik analiz

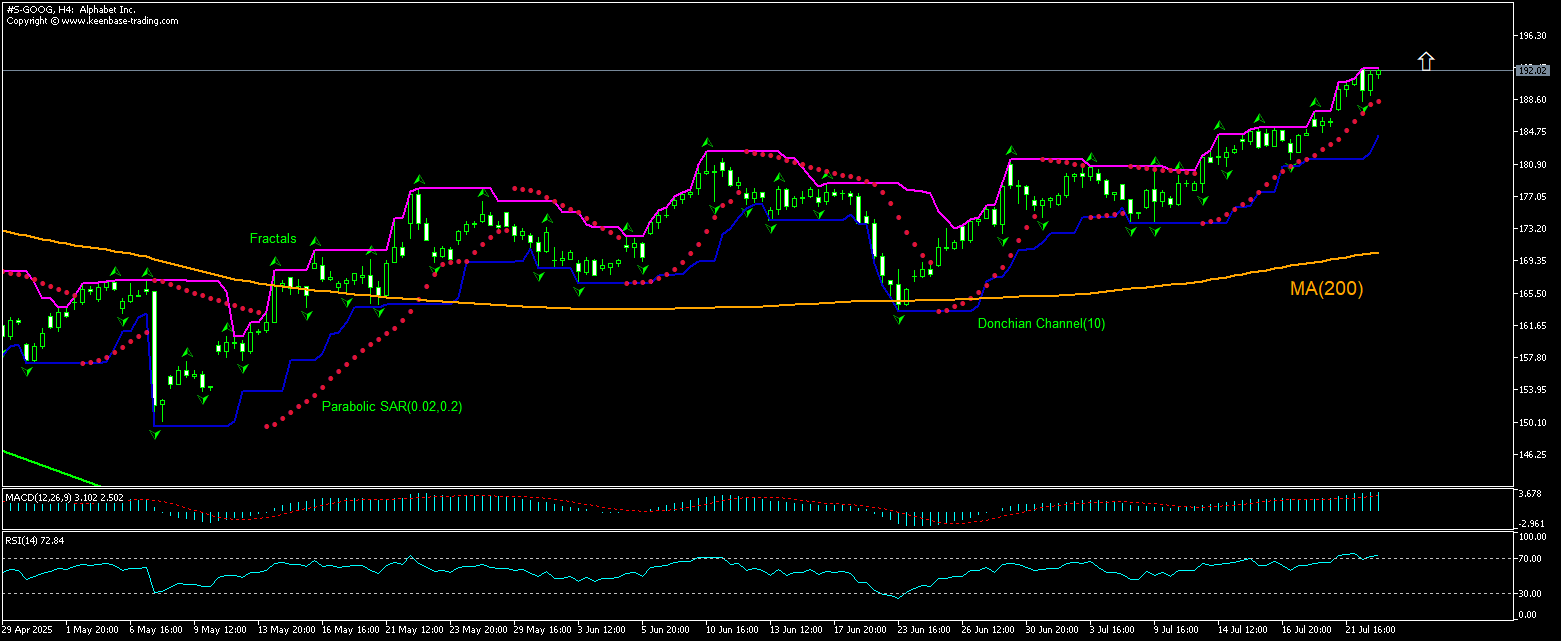

Alphabet Inc. Teknik Analiz - Alphabet Inc. Ticaret: 2025-07-23

Alphabet Inc. Teknik Analiz Özeti

Above 192.43

Buy Stop

Below 188.40

Stop Loss

| Gösterge | Sinyal |

| RSI | Sat |

| MACD | AL |

| Donchian Channel | AL |

| MA(200) | AL |

| Fractals | AL |

| Parabolic SAR | AL |

Alphabet Inc. Grafik analizi

Alphabet Inc. Teknik analiz

The technical analysis of the GOOGLE stock price chart on 4-hour timeframe shows #S-GOOG,H4 is rebounding after testing the 200-period moving average MA(200) as the price retreated to 9-week low a month ago. RSI is in the overbought zone. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 192.43. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below at 188.40. After placing the order, the stop loss is to be moved every day to the next fractal low indicator following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (188.40) without reaching the order (192.43), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Temel analiz Hisse senetleri - Alphabet Inc.

Google stock price closed higher after news of deal to license the technology of Windsurf. Will the GOOGLE stock price rebounding continue?

Shares of Google parent Alphabet rose after reports Alphabet Inc. has agreed to pay about $2.4 billion for a deal to license the technology of Windsurf, a startup specializing in AI coding tools. As part of the deal, Alphabet has hired Windsurf’s CEO Varun Mohan, co-founder Douglas Chen, and selected R&D team members to join Google’s DeepMind division. This team will focus on AI-driven software development projects, primarily working on Google’s Gemini AI initiative. Before the news of the deal there were reports of breakdown of negotiations of potential acquisition of Windsurf by OpenAI, which had offered $3 billion but ultimately did not close. Enhancement of Alphabet’s AI-driven software development capabilities is bullish for Google stock price. Alphabet will report second quarter results after the market closes today. An Alphabet search-revenue erosion, lower than expected performance in areas such as Cloud margins or advertising revenue are downside risk for Google stack price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop out seviyesi %10

Ready to Trade?

Open Account Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.