- Analytics

- Market Overview

The US GDP growth was less than expected - 1.8.2016

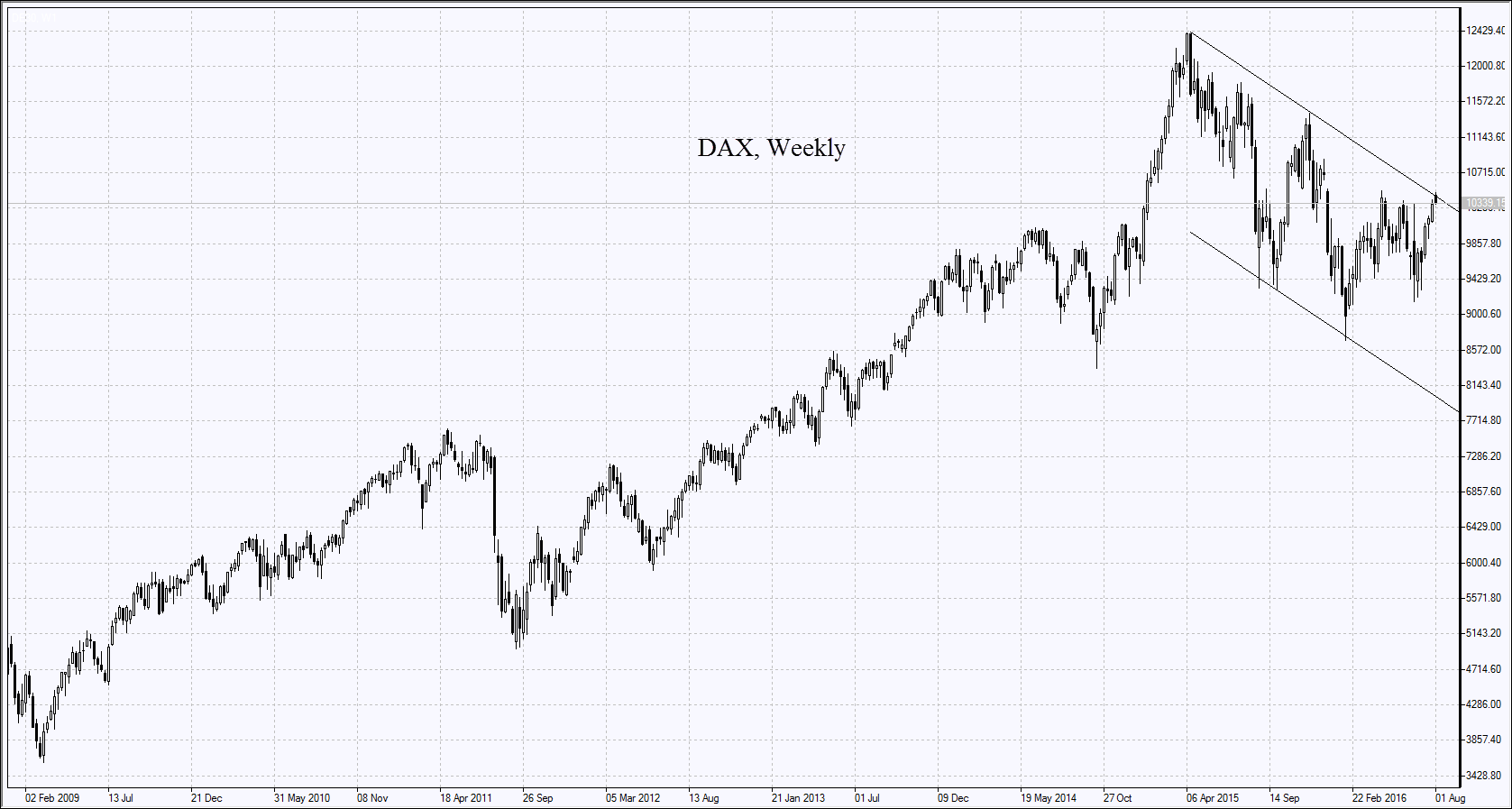

In July, the pan-European STOXX Europe 600 EUR index rose by 3,6%. On Monday, its growth is mainly contributed by the shares of banks, which are becoming expensive against the backdrop of the annual stress tests by the European Banking Authority. But there is also good news. The stocks of the most “problematic” Italian bank Monte dei Pasch rose by 5,8% and the stocks of German Deutsche Bank – by 2,6%. The quotations of the Raiffeisen and UniCredit banks have decreased, which limited the overall growth of the banking sector. The stocks of the British mining company Anglo American rose by 4% after the increase of its profit forecasts. This has contributed to the growth of quotations of other companies from this sector. This morning positive July industrial PMIs for Germany and for the whole Eurozone were published in the EU. Today, no more significant macroeconomic statistics are expected.

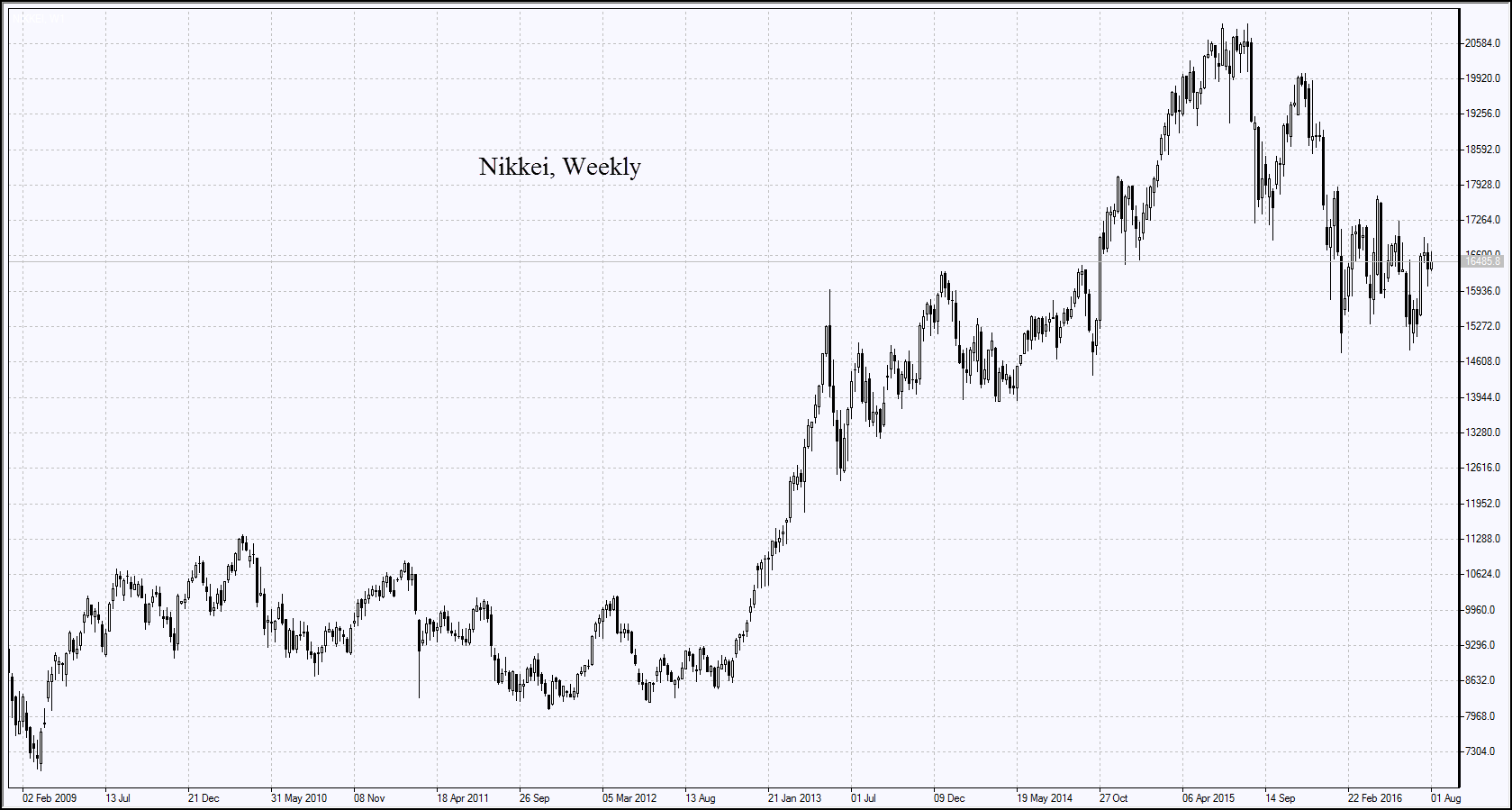

Nikkei rose on Monday due to the decision of the Bank of Japan to double the annual volume of redemption of ETFs to 6 trillion yen from 3.3 trillion yen. The volume of redemption of bonds and negative discount rate remained unchanged. The shares of Japanese banks and financial companies were leading the growth as on Friday. Note that tomorrow, the head of the Japanese government Shinzo Abe is going to present a plan for additional expenses to stimulate the economy of $ 28 trillion yen. This may affect the quotation of Japanese assets. In addition, on Tuesday, at 7:00 CET, positive July consumer confidence index will be released in Japan.

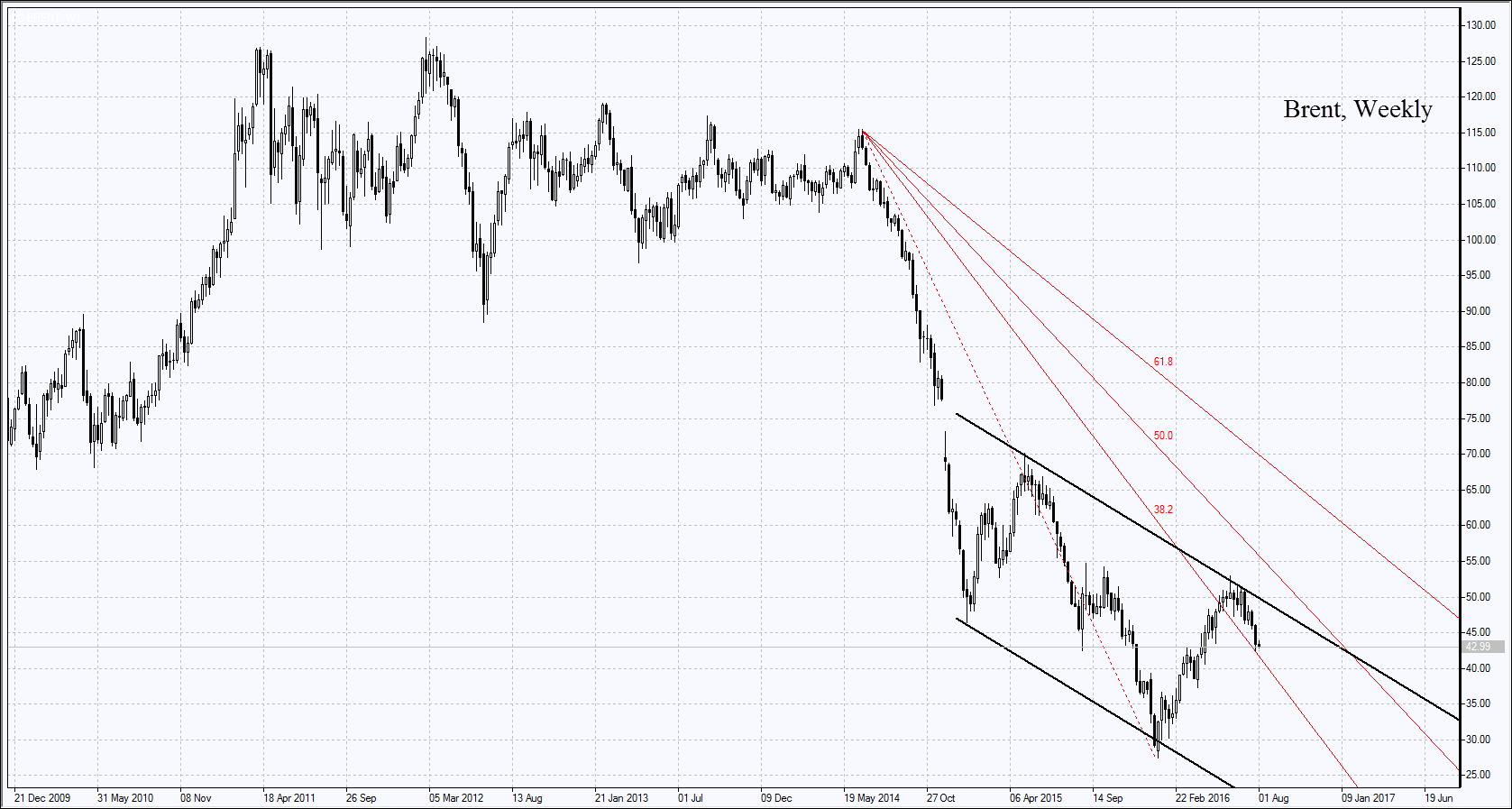

On Monday, the industrial PMI by Caixin/Markit was released in China. According to the results of July, it rose for the first time in the last 17 months, significantly exceeded the forecasts (48.7 pips): 50.6 points. This PMI has exceeded 50 pips for the first time since February, 2015. Market participants do not exclude the recovery of growth of the Chinese economy, which has had positive impact on the quotations of commodity futures. Note that in July of the current year, China's oil demand rose by 2,9% compared with the same period of 2015 and was 11,06 million barrels per day. By the consumption of oil, it is on the 3rd place in the world after the United States and the European Union.

See Also