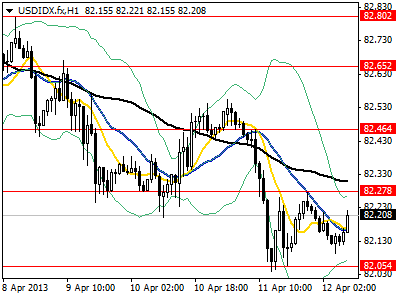

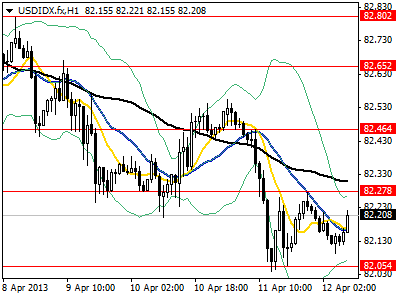

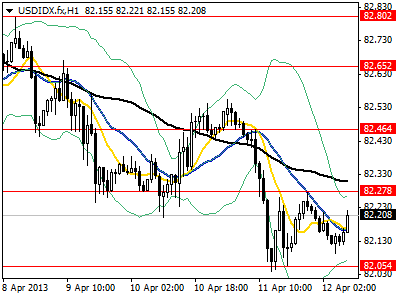

US dollar depreciated in yesterday’s evening session with the US dollar Index falling below support at 82.20 as risk appetite grew stronger. US unemployment claims the previous week were 346K less than expected 362K and down compared with two weeks ago revised claims at 388K. In addition, US indices maintained rally and advanced to new record highs with S&P 500 rising by 0.36%, Dow Jones Industrial Average gaining 0.42% and the NASDAQ closing slightly higher at 3300.16. Despite that US dollar index found floor at 82.03 and rebounded back to 82.27 as US equities gained, the index was unable to hold its ground. The Gold eased from resistance at 1590.28 that was trading on Tuesday to support at 1554.05 as risk sentiment improved and concerns for new FED QE round moderately faded.

The USDJPY remains in consolidation modestly lower than psychological level at 100, in earlier trading rose as high as 99.94 but now is trading around 99.40. Asian shares were mostly negative, NIKKEI 225 closed lower by 0.47% and Hang Seng dropped by 0.15% while in Australia the S&P/ASX200 rose by 0.13%. In Europe, ahead of Ecofin meeting in Dublin due to Ireland’s presidency, the Euro is lower from recent peaks at 1.3134 against the greenback, the pair is currently trading at 1.3072. Technically formed a reversal pattern and we expect correction in the intraday towards 1.3040. Looking ahead, US Retail Sales release later today is expected to show no growth limiting risk-on, followed by Michigan Consumer Confidence projected to improve slightly.