- Analytics

- Market Overview

S&P 500 closed in red 3 straight weeks - 16.3.2015

European stocks edge higher. Stoxx 600 has closed in the green for 6 consequent weeks, rising to its strongest since 2007. Now it shows 16.7 P/E ratio per share, the maximum over 10 years. German DAX has increased 22% this year and has bridged today the 12000 mark for the first time. The main reason is the bond-buying programme launched. As it occurred in the US, after Fed started the quantitative easing, a part of funds will funnel European stocks. We remind that American S&P has rallied 100% since March, 2009. And then, the euro, which has slumped to its low since January, 2003, makes European products more competitive. No statistics of great importance are anticipated today in eurozone. At 19:45 CET head of ECB Mario Draghi speaks in Frankfurt.

Nikkei has been rising today in tandem with European indices. To be noted, Bank of Japan is carrying out money emission. Since last July the euro has plummeted about 22%, the yen has slashed 21%. Next morning at 4:00 CET Bank of Japan policy statement will be published and Haruhiko Kuroda (Bank of Japan chair) will hold a press conference.

Oil quotes have declined today in prospect of disputes on Iranian nuclear programme to be settled. Market participants expect the sanctions against the country to be lifted encouraging growth in Iranian oil export. Besides, the strengthening dollar and growing US and Chinese oil reserves produced additional pressure on the quotes. However, according to Bakers Hughes, operating oil rigs were reduced to 986. It is 39% less than in May, 2014 when the quantity reached its highest. To be mentioned, reduction in rigs hasn't hampered production yet. Oil supply in the US has expanded to its strongest since 1972, making up 9.3 mln barrels daily.

Copper has been advancing for 3 consequent days due to the sustainable demand in China. Chilean company Antofagasta reported probable closure of Los Pelambres copper mine because of rising ground water level. About 405 thousand tons of copper was extracted there last year. According to US Commodity Futures Trading Commission (CFTC), hedge funds reduced last week net long gold and silver positions to the 4-month low and built up copper net longs. Because of the stronger dollar gold dropped to the 3-month minimum. Probable rate hike in the US suppresses the demand for gold. Last week SPDR Gold Trust reserves have plunged to this year low amounting to 750.7 tons. Meanwhile, the demand for physical gold remains sustainable. The premium on the precious metal at Shanghai Gold Exchange stays above $5-6 per ounce.

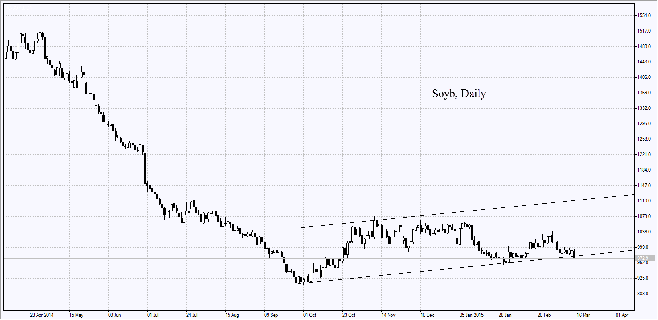

The rising dollar has brought down crop futures. Wheat has shown the smallest decline due to the estimated drought in the US. According to Agripac agency, soy crops in Argentine in 2014/2015 may decline 1-2.5 mln tons because of flood. Earlier the agency expected them to be 55.5 mln tons as Ministry of Agriculture forecasted 58 mln tons.

See Also