- Analytics

- Market Overview

Nasdaq hit fresh historical high - 15.8.2016

US stocks and US dollar edged lower on Friday on weaker than expected economic data. Retail sales remained unchanged in July although their rise by 0.4% was anticipated. The Consumer confidence index by Michigan University for August advanced less than expected. Producer price index fell 0.4% in July which is its record decline in almost a year which may negatively affect US corporate earnings. Anyway, with high Р/Е ratio such decrease in prices is not critical. Dow and S&P 500 stock indices slightly fell on Friday. The EU competition authorities decided to scrutinize the planned merger of Dow Chemical and DuPont which pushed their stocks 2.4% and 1.9% lower. The high-tech Nasdaq advanced on Friday to its fresh historical high mainly as stock of visual computing technology producer Nvidia added 5.6% on strong quarterly corporate earnings. US dollar index is slightly retreating on Monday for the second straight day. After the weak data on Friday the chances for the December 2016 Fed rate hike fell to 43% from 47% on Thursday. The Atlanta Fed revised down its forecast of US GDP growth in Q3 to 3.5% from previously expected 3.7%. No significant economic data are expected today in US.

European stocks are gathering momentum on Monday having already almost recovered Friday losses. The pan-European STOXX 600 slightly fell in the last trading day last week as smelters stocks retreated. Companies were worried that the demand for their goods may fall due to Chinese economic slowdown. STOXX 600 has for the second time hit a fresh 7-week low today due to the increase in pharmaceutical stocks. The Belgian UCB confirmed in US the patent on its antiepileptic drug Vimpat. Its stocks sky-rocketed 8% while STOXX Europe 600 Health Care index rose almost 1%. Today many European countries celebrate the Assumption of the Virgin Mary holiday. No economic data expected. Euro is hovering around its Friday close.

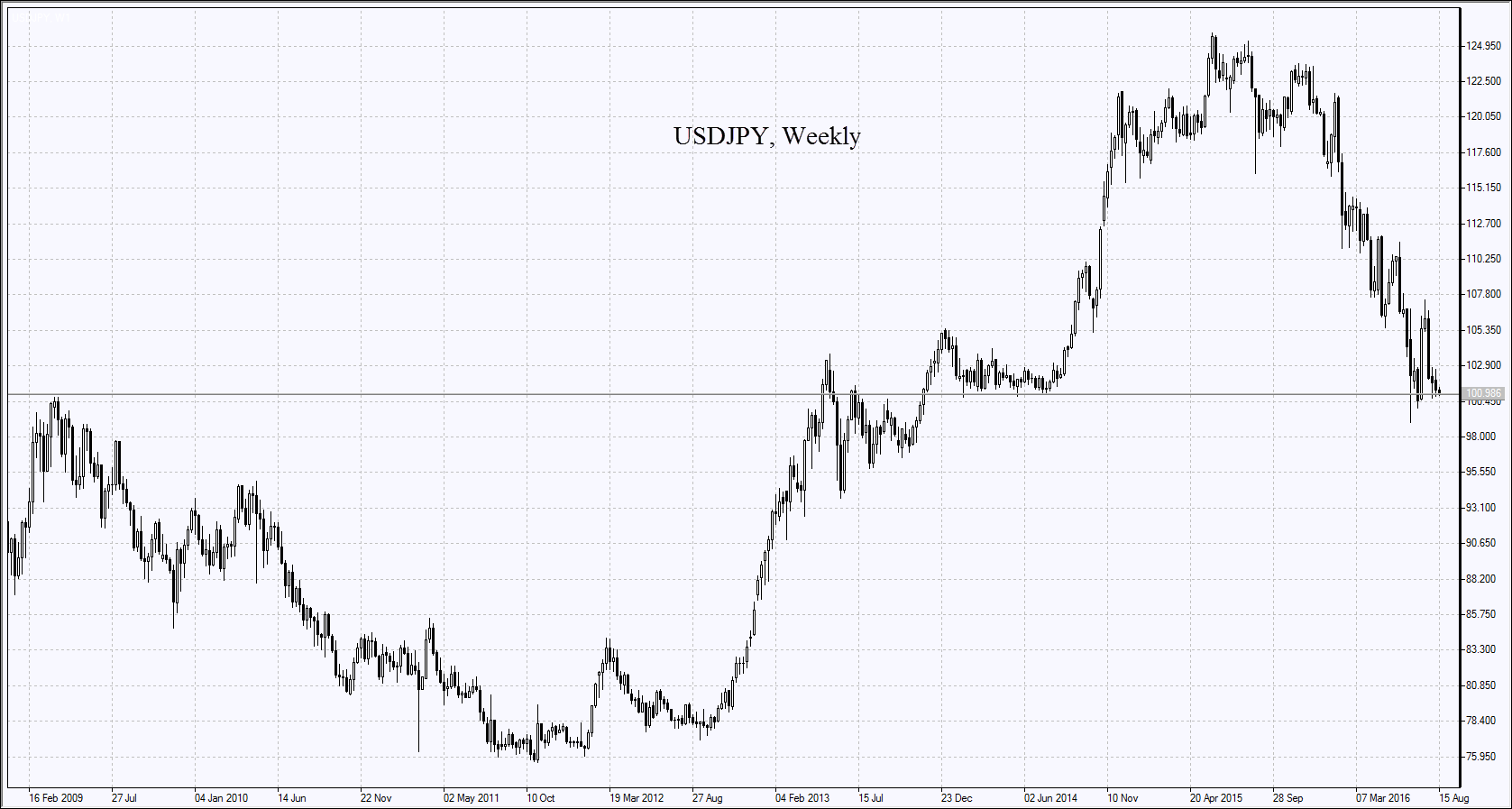

Nikkei slightly retreated on Monday amid two days of stronger yen. Today trading volume on Tokyo exchange was the lowest since April 2014 as many market participants celebrate the Buddhistic holiday. Early in the morning the weak economic data were released. The Japan’s GDP for Q2 rose 0.2% year on year which is far below the forecasted +0.7% and +2% in Q1. The next significant economic data will come out in Japan on Thursday morning: the external trade balance for July.

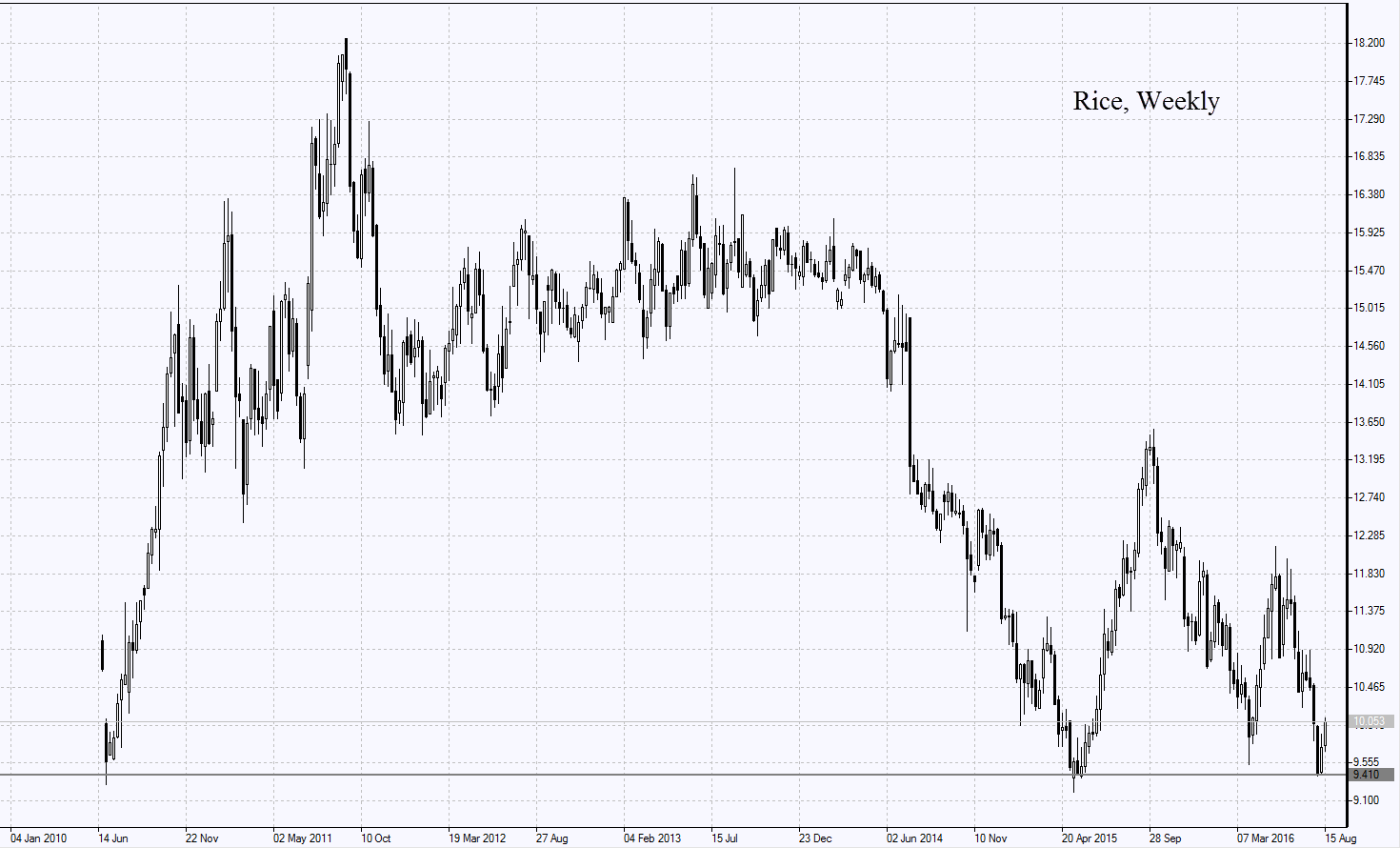

Rice surged after Vietnam reported its rice exports fell in 2016 to 4.75mln tonnes which is 27% below the last year level. Vietnam Food Association estimated in June the exports to be 5.7mln tonnes but, as we see, now almost 1mln lower estimate is given. Vietnam ranks 3rd among global rice exporters after India and Thailand. Meanwhile, soybeans also advanced amid their active purchases by China in US. They have been advancing already for 13 working days which made USDA cut the outlook for global soybean stocks at the end of this season to 255mln tonnes down from 350mln tonnes.

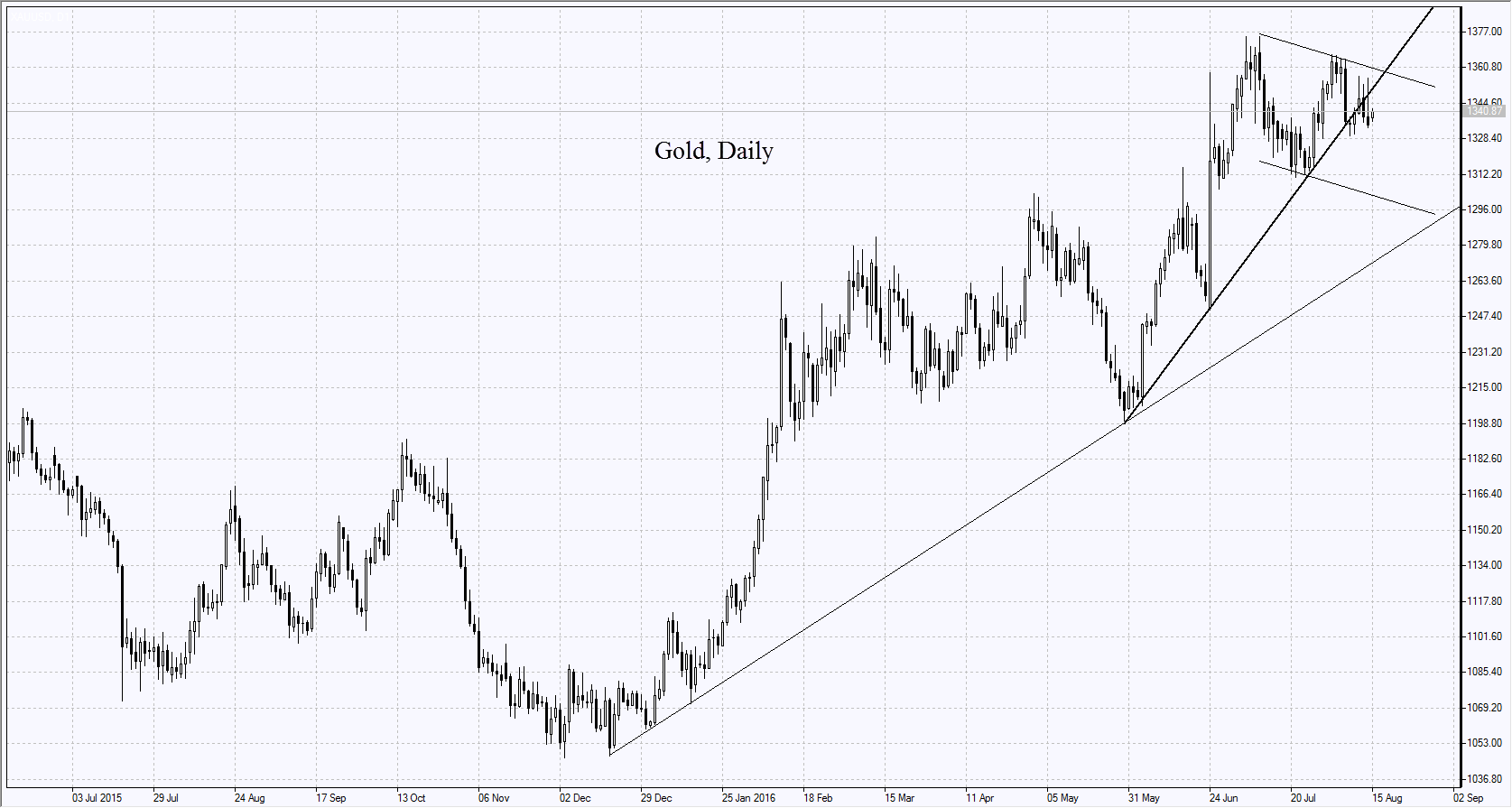

Gold slightly advanced on Monday amid weak US retail sales which militated against Fed rate hike. The gold stocks of world biggest Gold ETF SPDR Gold Trust fell on Friday by 1.22% but remained around one third above the start of 2016 while gold advanced 26%. US Commodity Futures Trading Commission noted the net longs in gold fell last week on COMEX. Early this July they reached the historical high.

See Also