- Analiz

- En Çok Kazananlar/Kaybedenler

Top Gainers and Losers: Australian dollar and Japanese yen

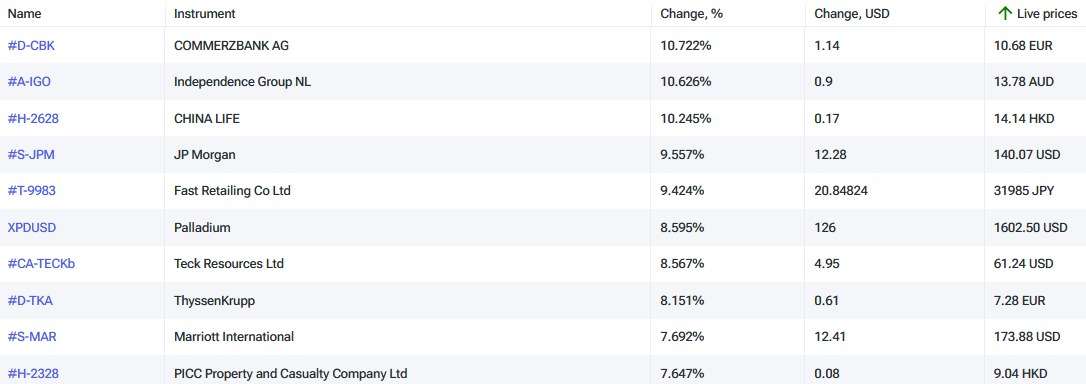

Top Gainers - global market

Top Gainers - global market

Over the past 7 days, the US dollar index has remained almost unchanged. Investors are expecting the Federal Reserve to raise interest rates from 5% to 5.25% at its meeting on May 3. According to CME FedWatch, the probability of such an event is estimated at 88.6%. The Australian dollar has strengthened in anticipation of inflation data to be released on April 26, which could affect the Reserve Bank of Australia's decision to raise interest rates (+3.6%) at its meeting on May 2. Inflation in South Africa rose by 1% m/m in March, lower than expected (+1.4% m/m), which contributed to the strengthening of the South African rand. Inflation in Japan in March was 3.2% y/y, higher than expected (+2.6% y/y). Japan's trade balance in March was negative (deficit) for the 20th consecutive month, which has led to a weakening of the yen.

1. COMMERZBANK AG, +10.7% – German bank

2. Independence Group NL, +10.6% – Australian manufacturer of non-ferrous and precious metals

Top Losers - global market

Top Losers - global market

1. Seagate Technology – American manufacturer of computer storage drives and hard disk drives (HDDs)

2. Nokia Corporation – Finnish manufacturer of equipment for mobile communication.

Top Gainers - foreign exchange market (Forex)

Top Gainers - foreign exchange market (Forex)

1. CHFJPY, USDNOK - the rise in these charts means the strengthening of the Swiss franc against the Japanese yen and the US dollar against the Norwegian krone.

2. AUDJPY, AUDNZD - the rise in these charts means the weakening of the Japanese yen and the New Zealand dollar against the Australian dollar.

Top Losers - foreign exchange market (Forex)

Top Losers - foreign exchange market (Forex)

1. EURZAR, USDZAR - the decline in these charts means the weakening of the euro and the US dollar against the South African rand.

2. EURPLN, GBPAUD - the decline in these charts means the strengthening of the Polish zloty against the euro and the Australian dollar against the British pound.

Yeni Özel Analitik Araç

Herhangi bir tarih aralığı - 1 gün ila 1 yıl arası

Herhangi bir Enstrüman Grubu - Forex, Hisse Senetleri, Endeksler, vs.

Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.

Önceki En Çok Kazananlar ve Kaybedenler

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...