- Analiz

- En Çok Kazananlar/Kaybedenler

Top Gainers and Losers: US dollar and Australian dollar

Top Gainers - global market

Over the past 7 days, the US dollar index continued its growth for the 4th week in a row, the increase was provoked after the Fed raised the rate by 0.25% to 4.75% on February 1. Investors do not rule out a further increase in the rate to 5.5% by the end of 2023. The Mexican peso strengthened on strong performance of the Mexico Gross Domestic Product and Current Account, which were better than expected. In addition, in the first half of February, inflation slowed down a little in Mexico. The weakening of the Australian dollar contributed to the materials of the February meeting of the Reserve Bank of Australia (RBA). He considered raising the rate by 0.5% but ended up increasing it by 0.25% to the current level of 3.35%. Investors do not rule out a pause in the tightening of the monetary policy of the RBA at the next meeting on March 7. Recall that inflation in Australia in the 4th quarter of 2022 reached 7.8% y/y. This is much more than the RBA rate.

1. Orora Ltd, +19% – Australian manufacturer of bottles and cans for soft drinks.

2. Rolls-Royce Group, +17.2% – British manufacturer of aircraft and marine engines and equipment, as well as turbines for power generation

Top Losers - global market

1. AMP Ltd – Australian finance company

2. Intel Corporation – computer processor and equipment manufacturer.

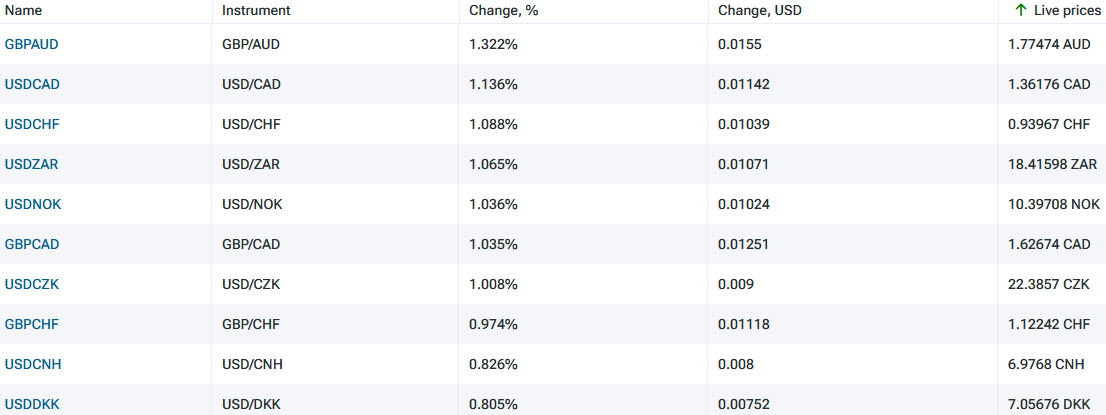

Top Gainers - foreign exchange market (Forex)

1. GBPAUD, USDCAD - the increase in these charts means the strengthening of the US dollar against the Canadian dollar and the British pound against the Australian dollar.

2. USDCHF, USDZAR - the increase in these charts means the weakening of the Swiss franc and the South African rand against the US dollar.

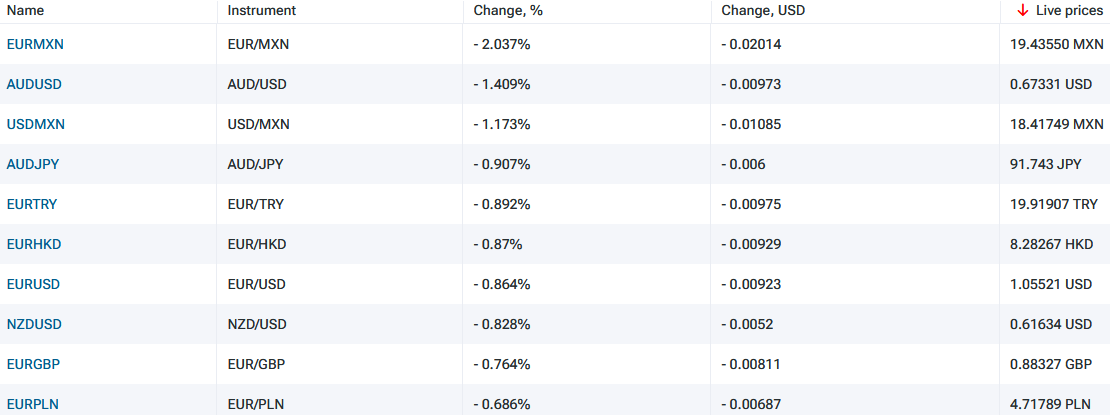

Top Losers - foreign exchange market (Forex)

1. EURMXN, USDMXN - the decrease in these charts means the weakening of the euro and the US dollar against the Mexican peso.

2. AUDUSD, AUDJPY - the decrease in these charts means the strengthening of the US dollar and the Japanese yen against the Australian dollar.

Yeni Özel Analitik Araç

Herhangi bir tarih aralığı - 1 gün ila 1 yıl arası

Herhangi bir Enstrüman Grubu - Forex, Hisse Senetleri, Endeksler, vs.

Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.

Önceki En Çok Kazananlar ve Kaybedenler

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...