- Analiz

- En Çok Kazananlar/Kaybedenler

Top Gainers and Losers: Japanese Yen and Canadian Dollar

Top Gainers - global market

Over the past 7 days, the US dollar index remained almost unchanged. Investors are looking forward to the Fed meeting on December 14 and the rate hike to 4.5% from the current level of 4%. The euro showed strengthening ahead of the next meeting of the European Central Bank on December 15th. His rate (2%) can also be raised. An additional positive for the euro was the EU GDP growth of 2.3% y/y in the 3rd quarter. This is more than expected. The yen strengthened in anticipation of the tightening of the monetary policy of the Bank of Japan at its December 20 meeting. In addition, Japan Gross Domestic Product fell less than expected in the 3rd quarter (-0.8% y/y). The weakening of the Canadian dollar was facilitated by a relatively small increase in the Bank of Canada rate at a meeting on December 7 - to 4.25% from 3.75%. The Mexican peso weakened as inflation fell to 7.8% y/y in November. This may prompt an easing of the monetary policy of the Bank of Mexico at its December 15 meeting. His rate is now 10%.

1. Sands China Limited, +22.9% – casino and hotel management company in Macau

2. Wynn Macau, Limited, +61.9% – casino and hotel management company in Macau

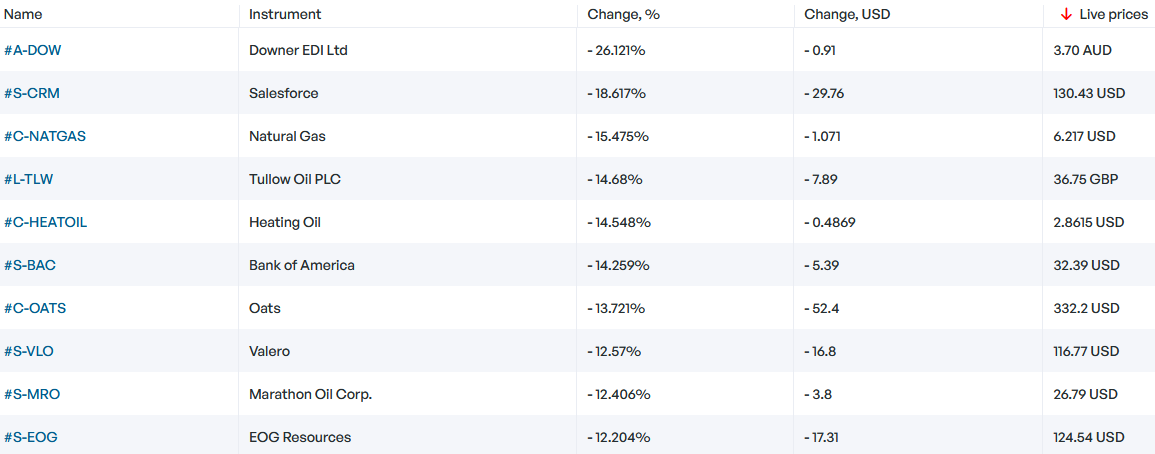

Top Losers - global market

1. Salesforce.com, inc. – American IT company, software developer

2. Downer EDI Limited – Australian multidisciplinary holding.

Top Gainers - foreign exchange market (Forex)

1. EURMXN, EURCAD - the growth of these charts means the strengthening of the euro against the Mexican peso and the Canadian dollar.

2. NZDCAD, GBPCAD - the growth of these graphs means the weakening of the Canadian dollar against the New Zealand dollar and the British pound.

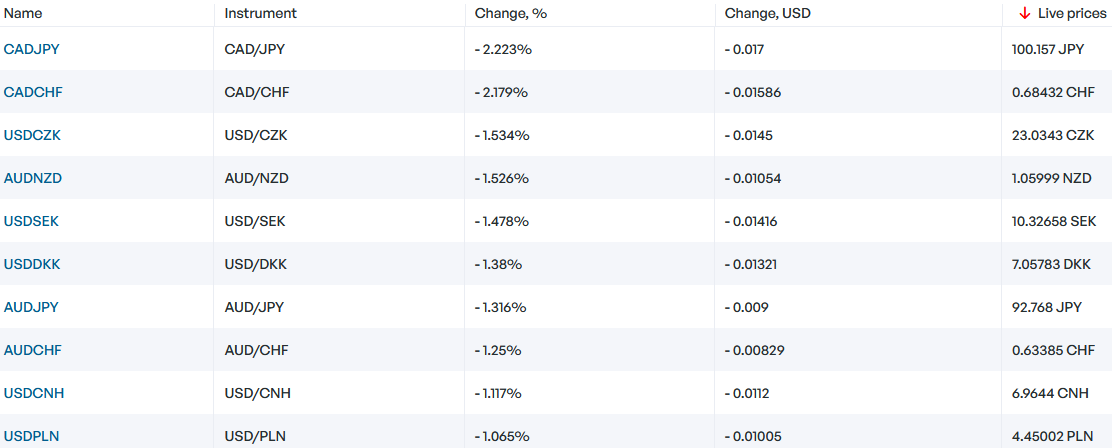

Top Losers - foreign exchange market (Forex)

1. CADJPY, CADCHF - the fall of these charts means the weakening of the Canadian dollar against the Japanese yen and the Swiss franc.

2. USDCZK, AUDNZD - the fall of these charts means the strengthening of the Czech crown and the New Zealand dollar against the US and Australian dollars.

Yeni Özel Analitik Araç

Herhangi bir tarih aralığı - 1 gün ila 1 yıl arası

Herhangi bir Enstrüman Grubu - Forex, Hisse Senetleri, Endeksler, vs.

Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.

Önceki En Çok Kazananlar ve Kaybedenler

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...